Makaleler

21

Tümü (21)

SCI-E, SSCI, AHCI (2)

SCI-E, SSCI, AHCI, ESCI (12)

ESCI (10)

Scopus (15)

Diğer Yayınlar (3)

5. The driving factors for the advance of Islamic finance in Southern Europe

Islamic Finance in Eurasia

, cilt.1, sa.10, ss.80-101, 2024 (Düzenli olarak gerçekleştirilen hakemli kongrenin bildiri kitabı)

10. House price index (HPI) and Covid-19 pandemic shocks: evidence from Turkey and Kazakhstan

INTERNATIONAL JOURNAL OF HOUSING MARKETS AND ANALYSIS

, cilt.15, sa.1, ss.108-125, 2022 (ESCI, Scopus)

20. Malaysia Crude Palm Oil Market Volatility: A GARCH Approach

International Journal of Economics and Management

, cilt.9, sa.2, ss.103-120, 2015 (Hakemli Dergi)

21. Malaysian crude palm oil market volatility: A GARCH approach

International Journal of Economics and Management

, cilt.9, sa.SpecialIssue, ss.103-120, 2015 (Scopus)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

28

5. Is rental control healthy for the economy? Evidence from Supply and Demand

3rd International Conference on Real Estate Development and Management and Management ICREDM2023, 1 - 04 Şubat 2023, ss.1-16, (Tam Metin Bildiri)

6. Housing Prices Increase at the global level and in OECD Countries and the Consequences: Evidence from Turkey

3rd International Conference on Real Estate Development and Management ICREDM2023, Ankara, Türkiye, 1 - 04 Şubat 2023, ss.1-15, (Tam Metin Bildiri)

7. Sukuk Investment in Providing Affordable Housing and Social Housing

3rd International Conference on Real Estate Development and Management 2023, Ankara, Türkiye, 1 - 04 Şubat 2023, ss.1-18, (Özet Bildiri)

8. Impact of Foreign Investors on the Turkish Construction Indusrty

International Scientific and Practical Symposium The Future of the Construction Industry: Challenges and Development Prospects (FCI-2023), Moscow, Rusya, 18 - 22 Eylül 2023, (Tam Metin Bildiri)

10. Küresel Düzeyde ve OECD Ülkelerinde Konut Fiyatları Artışı ve Sonuçları: Türkiye’den Sonuçlar

III. Uluslararası Gayrimenkul Geliştirme ve Yönetimi Konferansı, Türkiye, 01 Şubat 2023, (Tam Metin Bildiri)

11. Islamic Financial Products in Islamic Banks: Issues and Opportunities

The Second GPDRL Conference on Legal, Social-Economic Issues and Sustainability (GPDRLIC2023), Suudi Arabistan, 20 Mart 2023, (Tam Metin Bildiri)

12. Non-Interest-Bearing and Financing Models in Real Estate Acquisition and Investments

Reinforcing Environmental, Social & Governance Practices in the 21st Century (ESG 2023), Dubai, Birleşik Arap Emirlikleri, 15 Mart 2023, cilt.1, (Tam Metin Bildiri)

13. Kira Kontrolü Ekonomi İçin Sağlıklı Mıdır? Arz ve Talepten Elde Edilen Kanıtlar

III. Uluslararası Gayrimenkul Geliştirme ve Yönetimi Konferansı, Türkiye, 01 Şubat 2023, (Tam Metin Bildiri)

14. Uygun Fiyatlı Konut ve Sosyal Konut Sağlamaya Yönelik Sukuk Yatırımı

III. Uluslararası Gayrimenkul Geliştirme ve Yönetimi Konferansı, Türkiye, 01 Şubat 2023, (Tam Metin Bildiri)

15. Evaluation of Management Soundness of Takaful Industry in Selected Countries

29th National and 10th International Conference on Insurance and Development (ICID 2022), TAHRAN, İran, 04 Aralık 2022, (Özet Bildiri)

16. Influence of COVID-19 Pandemic on Resilience of Turkish Real Estate Markets

7th Conference of Interdisciplinary Research on Real Estate held in Department of Real Estate Management and Development (CIRRE2022), Türkiye, 14 Ekim 2022, (Özet Bildiri)

17. Transparency and Affordability of Housing Market: Evidence from Sectoral Level Analysis in Turkey

FIG Congress 2022 “Volunteering for the future – Geospatial excellence for a better living, Polonya, 14 Eylül 2022, (Tam Metin Bildiri)

18. Co-movements and volatility spillovers between Turkish real estate prices and capital market

2022 AsRES-AREUEA Joint Conference, Japonya, 06 Ağustos 2022, (Tam Metin Bildiri)

19. Performance Evaluation and Volatility of REITs as the World Adjusting to New Normal: A case of Turkey REITs. 2021 Joint Real Estate Conference by the Asian Real Estate Society (AsRES)

2021 Joint Real Estate Conference by the Asian Real Estate Society (AsRES), Çin, 18 - 20 Temmuz 2021, (Tam Metin Bildiri)

20. Performance Evaluation and Volatility of REITs as the World Adjusting to New Normal: A case of Turkey REITs

2021 Joint Real Estate Conference by the Asian Real Estate Society (AsRES), the Global Chinese Real Estate Congress (GCREC) and the American Real Estate and Urban Economics Association (AREUEA), Singapur, 20 Temmuz 2021, (Tam Metin Bildiri)

21. Will the Inclusion of Precious Metals in Nigerian Stocks and Oil Portfolio lead to Diversification Benefits in the Era of Covid-19? MGARCH-DCC Approach

22nd Malaysian Finance Association Conference 2020 (MFAC 2020), Virtual Conference, Malezya, 18 Kasım 2020, (Tam Metin Bildiri)

22. Risk Associated with Application of Mudarabah and Musharakah-Mutanaqisah in Real Estate Financing

ICREDM2020 International Conference on Real Estate Development and Management, Ankara University, Turkey, Türkiye, 01 Şubat 2020, (Tam Metin Bildiri)

Kitaplar

11

1. Land Acquisition for Tourism Investments and Evaluation of Incentives Regulations and Practices Regarding the Promotion of Tourism Investments: The Case of Turkey

Handbook of Tourism, Property & Real Estate , Narvada Gopy,Robin Nunkoo, Editör, Edward Elgar , Massachusetts, ss.1-400, 2024

2. Contributions of Turkish Tourism Development towards the Growth in Turkish Real Estates

Handbook of Tourism, Property & Real Estate , Narvada Gopy,Robin Nunkoo, Editör, Edward Elgar , Massachusetts, ss.1-400, 2024

3. The driving factors for the advance of Islamic finance in Sothern Europe

Islamic Finance in Eurasia: The Need for Strategic Change Studies in Islamic Finance, Accounting and Governance series, M. Kabir Hassan,Paolo Biancone,Aishath Muneeza, Editör, Edward Elgar , Massachusetts, ss.1-500, 2024

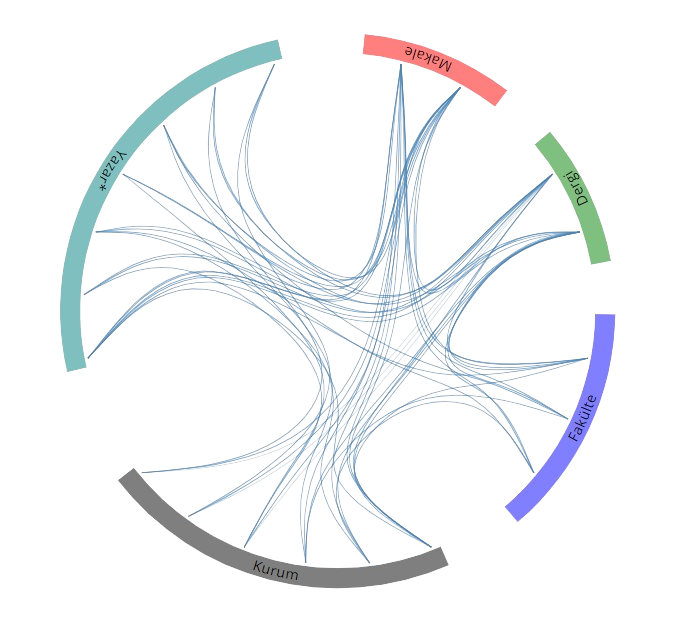

Yayın Ağı

Yayın Ağı